Algorand Ecosystem isolated market

Folks Finance is launching the Algorand Ecosystem isolated market. This feature is designed to support more volatile assets and community coins within the Algorand ecosystem. Each isolated market functions independently, so risks related to volatility, liquidity shocks, or price crashes do not impact the Core Market. This compartmentalization is essential for safely expanding the range of assets available for lending and borrowing.

The initial launch will include three assets: ALGO, USDC, and TINY. To effectively separate the risk associated with USDC and ALGO pools from the existing ones on Folks Finance Core Market, new isolated pools will be created for these assets. These pools will operate similarly to the Core Market but with fully segregated liquidity, meaning deposits and borrows are completely independent from the Core Market. This isolation ensures that introducing new and more volatile assets does not compromise the stability of the main Folks Finance lending market.

Key Features

-

Support for community coins and more volatile assets: Not all assets meet the liquidity or requirements needed for Core Market. Isolated markets offer a flexible environment where new assets can be listed, with dedicated risk parameters.

-

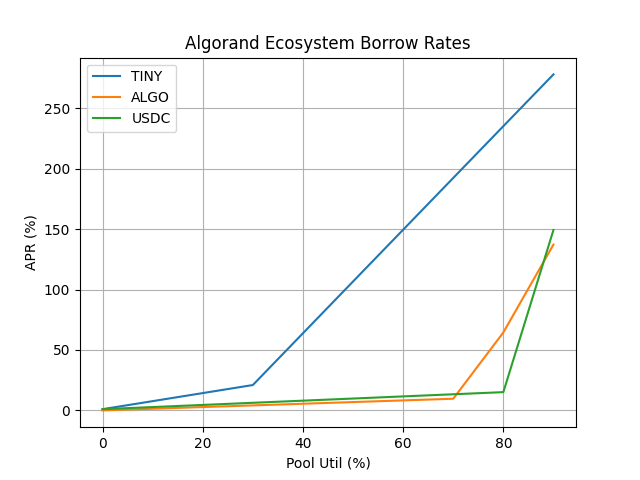

Customized Collateralization and Interest Rate Configurations: Each asset in the Algorand ecosystem isolated Market has proper rules related to collateralization ratios and interest rate curves, calibrated to ensure an optimal balance between flexibility for the user and security of protocol.

-

Liquidity Separation: ALGO and USDC pools in the isolated markets are completely independent of their counterparts in the Core Market, thus preventing problematic risks or debts in the isolated pools from impacting it.

TINY intro

TINY is the governance token for Tinyman, a decentralized exchange (DEX) on the Algorand blockchain. It is used to facilitate voting and decision-making within the Tinyman Governance system. Holding and committing TINY tokens allows users to participate in governance proposals and influence the direction of the Tinyman protocol.

Here below the assets parameters of ALGO,USDC and TINY.

| Parameters |

ALGO |

USDC |

TINY |

|

| Variable Base (RV0) |

0.00% |

1.00% |

1.00% |

|

| Variable Slope 1 (RV1) |

10.00% |

15.00% |

20.00% |

|

| Variable Slope 2 (RV2) |

200% |

400% |

300% |

|

| Stable Additional Base Rate (RS0) |

1% |

1% |

1% |

|

| Stable Slope 1 (RS1) |

1% |

1% |

1% |

|

| Stable Slope 2 (RS2) |

200% |

200% |

200% |

|

| Stable Excess Rate (RS3) |

40% |

40% |

40% |

|

| Optimal Utilisation Ratio (Uopt) |

72,50% |

85.0% |

30.0% |

|

| Optimal Stable to Total Debt Ratio (Oratio) |

10% |

10% |

10% |

|

| Rebalance Up Utilisation Ratio (URU) |

85% |

85% |

85% |

|

| Rebalance Up Deposit Interest Rate Percentage (DIRRU) |

75% |

75% |

75% |

|

| Rebalance Down Delta (RD) |

20% |

20% |

20% |

|

| Retention Rate (RR) |

30% |

25% |

30% |

|

| Flash Loan Fee |

0,10% |

0,10% |

0,10% |

|

| Borrow Cap ($) |

$1.000.000 |

$1.000.000 |

$60.000 |

|

| Single Stable Borrow Percentage Cap |

2,00% |

2,00% |

1,00% |

|

|

|

|

|

|

|

|

|

|

|

| Algorand market parameters |

ALGO |

USDC |

TINY |

|

| Collateral Factor |

60,00% |

75,00% |

40,00% |

|

| Borrow Factor |

100,00% |

100,00% |

110,00% |

|

| Collateral Cap ($) |

$300.000 |

$250.000 |

$120.000 |

|

| Liquidation Max |

50,00% |

50,00% |

50,00% |

|

| Liquidation Bonus |

15,00% |

15,00% |

20,00% |

|

| Liquidation Fee |

15,00% |

15,00% |

15,00% |

|

5 Likes

Will there be an additional loan type for isolated? If there are additional isolated markets say for xUSD, ball sack or monko will those markets share common USDC and algo pools? Or will each isolated market have isolated algo and USDC pools?

Have any consideration been given to reduce risk to flash loan attacks?

2 Likes

There will be no additional loan types, and they will share the same USDC and Algo pools (within the ecosystem market). The Folks feed oracle is protected against FL attacks

3 Likes

Thanks for the reply. Has folks settled on a process to add additional ASAs to the algorand ecosystem isolated market? Also will it be possible to have stable coin efficiency type loans in the algorand ecosystem market?

The optimal utilization for tiny seems too low. 100% APR at 50% pool utilization is pretty oppressive. IMO optimal utilization for ALGO and USDC could be lowered. I could be wrong but it seems that the ALGO and USDC depositors are taking the bigger risk and the rates they receive should be in line with the risk. Also the retention rate is much higher than the core markets. For example USDC RR is 10% for core market but 25% for ecosystem market. I understand that the protocol has to get a cut but 30% seems excessive.

Not at the moment, but after the TINY listing new assets will be evaluated, also we have already collected community feedbacks on their preferences. We can potentially evaluate to enable a new stable efficiency type if there will be a new stable listing, due diligence will be made first

Thank you for the feedback Don.

- On TINY’s interest curve rate

Your observation that borrowing rates for TINY can rise sharply is correct. This has been designed to ensure that any potential manipulation would be expensive. At the same time, this design ensures a fair reward mechanism: the high cost paid by borrowers directly translates into high yields for TINY depositors. That said, this parameter will certainly be adjusted upward if borrow demand grows and DEX liquidity increases.

- On compensation for ALGO and USDC depositors

Adequate risk-adjusted compensation for depositors of the assets that will be most borrowed is the basis of this “riskier” market. Our model addresses this problem not by lowering the Uopt, but by exploiting a more aggressive slope (RV1) than the main market.

This ensures that, at any level of utilization, the APY for ALGO and USDC depositors is structurally higher than the main market, reflecting the additional risk. This risk is further mitigated by caps, TINY collateral factor, and pool isolation.

- On the Reserve Factor (RR)

A higher Reserve Factor is part of our safety strategy. This is not a standard market; it is an environment for more experimental assets where the intrinsic risk of “bad debt” is higher.

RR acts as an insurance mechanism. A higher value allows the protocol to quickly build a safety fund. This fund serves as the first and most critical line of defense, protecting all depositors’ capital in adverse scenarios.

1 Like

Thank you for the thoughtful reply. On points 1 and 2 (Tiny curve and Algo/USDC borrow rates) my initial concern was that the most likely manipulation/risk to protocol is that the price of Tiny is artificially inflated to extract Algo/USDC from the protocol. Imo aggressive tiny curve doesn’t address tiny price manipulation because tiny itself wouldn’t be borrowed. The reasons why one would borrow tiny is to short it or to get higher returns elsewhere. With such an aggressive borrow rate curve the protocol seems to be discouraging borrowing. What kind of manipulation is the concern to the protocol when it comes to borrowing Tiny? As long as the borrow rate is above the Tiny rate of return for Tiny governance it’ll be too expensive to try to manipulate Tiny rewards by borrowing Tiny from Folks.

On point 3, the documentation indicates RR is “the interest kept by the protocol as revenue.”. The purpose you have outlined here is different. The documentation should probably be updated.

1 Like

The first layer of protection is the asset cap, which already limits potential exposure. On top of that, the steep borrow curve is designed to discourage undesirable behaviors, like large-scale shorting.

RR goes to the treasury and one of the use cases of it is to act as insurance against bad debts

3 Likes